baton-rouge-tree-services.site

Community

Best Cd Rates Local Banks

CD rate news The best CDs currently range from % to % — with some promo rates as high as % — which is higher than average compared with the. Highest Online Savings Rates ; Poppy Bank · % APY ; Brilliant Bank, a division of Equity Bank · % APY ; Climate First Bank · % APY ; Vio Bank, A. The best CD rate right now is % APY from DR Bank for a 6-month term. That APY is nearly three times the FDIC's national average rate of % on a. Found certificate of deposit rates In Austin, Texas change ; Broadway Bank. W 38th St Austin, TX % ; Capitol Credit Union. Lavaca St. Local personalized support. Connect with a small business specialist to Top banks are the top 20 banks by total deposits across TD MSAs, the top. Promotional CD · You want flexible terms and competitive rates. You want flexible terms and competitive rates. · $5, ; Short-term Standard CD · You're looking to. The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. TAB Bank offers a great 1-year business CD, with a % APY. The $1, minimum deposit requirement is not great, but its interest rate is the highest around. A closer look at the best 1-year jumbo CD rates · Credit One Bank – % APY, $, minimum deposit for APY · Suncoast Credit Union – % APY, $, CD rate news The best CDs currently range from % to % — with some promo rates as high as % — which is higher than average compared with the. Highest Online Savings Rates ; Poppy Bank · % APY ; Brilliant Bank, a division of Equity Bank · % APY ; Climate First Bank · % APY ; Vio Bank, A. The best CD rate right now is % APY from DR Bank for a 6-month term. That APY is nearly three times the FDIC's national average rate of % on a. Found certificate of deposit rates In Austin, Texas change ; Broadway Bank. W 38th St Austin, TX % ; Capitol Credit Union. Lavaca St. Local personalized support. Connect with a small business specialist to Top banks are the top 20 banks by total deposits across TD MSAs, the top. Promotional CD · You want flexible terms and competitive rates. You want flexible terms and competitive rates. · $5, ; Short-term Standard CD · You're looking to. The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. TAB Bank offers a great 1-year business CD, with a % APY. The $1, minimum deposit requirement is not great, but its interest rate is the highest around. A closer look at the best 1-year jumbo CD rates · Credit One Bank – % APY, $, minimum deposit for APY · Suncoast Credit Union – % APY, $,

Best 1-Year CD Rates · Why You Can Trust Our Recommendations for the Best 1-Year CD Rates · Mountain America Credit Union – % APY · Merchants Bank of Indiana –. Found certificate of deposit rates In Austin, Texas change ; Broadway Bank. W 38th St Austin, TX % ; Capitol Credit Union. Lavaca St. RATES AND APY'S ARE ACCURATE AS OF THE DATE REFERENCED AT THE TOP OF THIS DOCUMENT AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. A PENALTY WILL BE IMPOSED FOR EARLY. Our top picks for banks with the best 1-year CD rates · Barclays · BMO Alto · Capital One · Marcus · Quontic · Sallie Mae. Early withdrawal penalty applies. See details below. ; For Featured CD Account · % ; For Standard Term CD Account · % ; For Flexible CD Account Grow your savings fast with a % APY* for a 5 month CD**. Learn more · Special Promotional CD Rates. Lock in a fixed rate with an online-only certificate of deposit with month and 8-month CDs at Citizens. View online CD rates and open an account today. Top Local Branch Rates. Savings; Checking; 1 Year CD; 5 Year CD. %. Advantage Federal Credit UnionRound-Up Savings · %. ESL Federal Credit UnionTiered. Promotional CD · You want flexible terms and competitive rates. You want flexible terms and competitive rates. · $5, ; Short-term Standard CD · You're looking to. Synchrony Bank has more CDs than many banks, offering terms from three months to five years. The short- to medium-term products are particularly impressive. Bask Bank began offers six CD terms ranging from three months to two years. The bank also offers a savings account with a competitive APY and another savings. Earn up to % APY 1 on a Certificate of Deposit · Find the right CD account rates and terms for your savings goals. · You may also be interested in: · Privacy. Certificate of deposit with at least 6% interest ; Institution, Term, Highest APY Available ; Financial Partners Credit Union. 8 months. % ; BP Federal Credit. Certificate of Deposit (CD) accounts usually pay you a higher interest rate than a traditional savings account. Compare CD types and rates to get started. The average rate for a 1-year CD in the U.S. is % APY (Annual Percentage Yield) according to the FDIC. However, the best online banks and credit unions. Bankrate's picks for the top 1-year credit union CD rates · America First Credit Union: % APY, $ minimum deposit · Alliant Credit Union: % APY, $1, Current CD Rates. CD TERM, $1,$24,, $25,$,, $, and over. 5-Month, % APY*. View CD Rates of over banks and credit unions so you can be sure to get the best rates on the market! Summary of the highest CD rates ; Sallie Mae certificates of deposit · %, % ; My eBanc Online Time Deposit · %, % ; Bread Savings certificates of. Bankrate's picks for the top 5-year CD rates · SchoolsFirst Federal Credit Union · First Internet Bank of Indiana · America First Credit Union · Synchrony Bank.

Best Company For Loans With Bad Credit

If you've got an $ min. monthly income, you could qualify for a loan from MoneyMutual. They've got some low-credit options so they're worth. Even those with bad credit may qualify for startup funding. The lender will provide you with a full list of eligibility requirements for your loan. Be a for. Compare the best bad credit loans, vetted by experts to help borrowers with poor credit, find loans with the lowest cost and fees and flexible loan terms. With a simpler application, faster turnaround, and flexible approval requirements, Greenbox Capital can fund more businesses with low credit in as little as one. What is a bad credit loan? ; , , , Fair ; , , , Good. Bad Credit Loan. Frequently Asked Questions. What are the best loans for people with bad credit? Although many options are available for those with poor. OneMain Financial generally accepts applicants with at least a poor or fair credit score (the exact credit score minimum is not disclosed but for reference, a. To determine what credit score is needed for a bad credit loan near you, let's talk about credit ranges and exactly what "bad credit" is. A poor FICO score is. Also, owing only small amounts of money—or having low usage numbers—will help maximize your score. Again, having bad credit won't necessarily disqualify you. If you've got an $ min. monthly income, you could qualify for a loan from MoneyMutual. They've got some low-credit options so they're worth. Even those with bad credit may qualify for startup funding. The lender will provide you with a full list of eligibility requirements for your loan. Be a for. Compare the best bad credit loans, vetted by experts to help borrowers with poor credit, find loans with the lowest cost and fees and flexible loan terms. With a simpler application, faster turnaround, and flexible approval requirements, Greenbox Capital can fund more businesses with low credit in as little as one. What is a bad credit loan? ; , , , Fair ; , , , Good. Bad Credit Loan. Frequently Asked Questions. What are the best loans for people with bad credit? Although many options are available for those with poor. OneMain Financial generally accepts applicants with at least a poor or fair credit score (the exact credit score minimum is not disclosed but for reference, a. To determine what credit score is needed for a bad credit loan near you, let's talk about credit ranges and exactly what "bad credit" is. A poor FICO score is. Also, owing only small amounts of money—or having low usage numbers—will help maximize your score. Again, having bad credit won't necessarily disqualify you.

While having a good credit score is key to being able to get loans and approvals, there are many people with poor credit. This can be due to any number of. These types of bad credit loans for those with poor credit scores provide access to borrow money in the future as well, as long as you make your monthly. If your score is below , you probably should look into an FHA loan or VA loan. Of course, the best option is to work on repairing your credit score before. Check with local credit unions. A credit union personal loan may benefit those who have bad credit when it comes to debt consolidation. Credit unions are not-. Because lenders generally look at borrowers with bad credit as high-risk investments, it can be hard to qualify for a loan with a poor or fair credit score. Bad credit personal loans with no credit check. If your credit score is very low (or non-existent), it might be worthwhile to seek out a lender who will approve. It's possible to get a personal loan with poor credit, but it can be expensive. Personal loan APRs vary widely by credit score, and applicants with low credit. loans for people with poor credit, and installment loans of up to $1, What are the best online payday loans for bad credit in Ontario? The best. Getting a personal loan in Canada for a poor credit is now simple. You just need to contact a company like Northstar Brokers, a specialized brokerage firm. Loans for Bad Credit We understand a low credit score can make it difficult to get an affordable loan so we don't base our funding decisions exclusively on. A low credit score should not limit you from getting a loan. Find the best loans for bad credit at the best rates for you. Yes, you can get a personal loan with bad credit by comparing interest rates and fees from lenders that offer loans designed for borrowers with bad credit. Looking for a bad credit loan? Use Borrowell to quickly find loans that match your credit profile. Instantly see your chances of approval, even with bad. There are plenty of lenders that offer loans for people with poor or no credit history. If you are looking for a loan with bad credit, then you have come to the. Best Egg offers the best personal loans for bad credit with a low minimum APR, starting at %. The company also has loan amounts of $2, - $50, and a. On top of that, a low credit score can have a negative effect on a person's mental well-being as well. Where to get loans with a bad. How to Choose a Loan Based on Your Business Needs and Credit Score; What Lenders Look at on a SMB Loan Application; How to Get a Better Business Loan in the. At GNCU, we offer loans for bad credit to help you rebuild your credit and start fresh. If you can qualify for GNCU membership by living or working in Nevada. Our installment loans with guaranteed approval in Canada are extremely flexible! Poor, low, or bad credit is OK. Bad Credit Loans Instant Approval. Here at Loan.

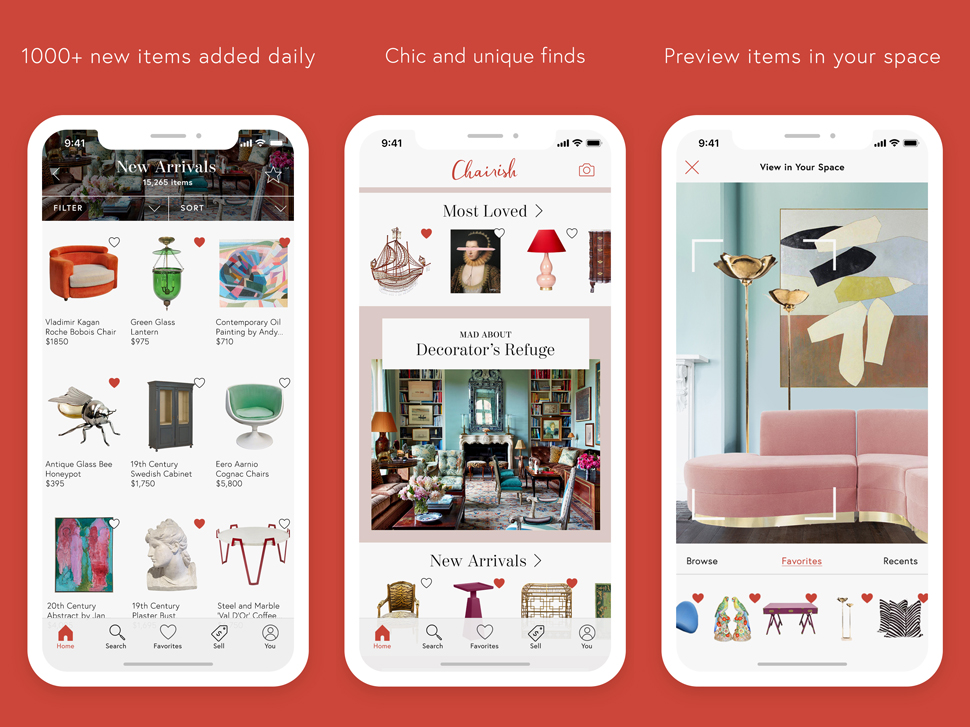

Local App For Selling Stuff

OfferUp is a person-to-person app to buy and sell stuff locally. People usually get their material on there at the local drop sites (identified. OfferUp is particularly great for selling furniture, video games, and household items. Because the homepage of the app mixes in all types of items, you don't. Instantly connect with local buyers and sellers on OfferUp! Buy and sell everything from cars and trucks, electronics, furniture, and more. Decluttr is a website and app that allows you to sell your unwanted or unused items for cash. They will buy a wide assortment of things like CDs, DVDs & Blu-. The top-selling apps are Facebook Marketplace, LetGo, Gazelle, and Craigslist. There are plenty of options for selling your things and padding your wallet. Features of Pxsell: Buy Sell Trade: Fast growing marketplace for local buyers and sellers; List an item in as little as 15 seconds; Browse local items for sale. Best Apps for Selling Stuff Locally Before Moving to a New House · 1. Carousell · 2. LetGo · 3. OfferUp · 4. CPlus for Craigslist · 5. Facebook · 6. eBay · 7. You can likely obtain more money selling your items on your own either locally or using an online sales platform, such as eBay, but Decluttr is the easiest of. 5miles is designed for local use. It displays items for sale based on your location, from cars to furniture to appliances. Safety is a priority on the site, and. OfferUp is a person-to-person app to buy and sell stuff locally. People usually get their material on there at the local drop sites (identified. OfferUp is particularly great for selling furniture, video games, and household items. Because the homepage of the app mixes in all types of items, you don't. Instantly connect with local buyers and sellers on OfferUp! Buy and sell everything from cars and trucks, electronics, furniture, and more. Decluttr is a website and app that allows you to sell your unwanted or unused items for cash. They will buy a wide assortment of things like CDs, DVDs & Blu-. The top-selling apps are Facebook Marketplace, LetGo, Gazelle, and Craigslist. There are plenty of options for selling your things and padding your wallet. Features of Pxsell: Buy Sell Trade: Fast growing marketplace for local buyers and sellers; List an item in as little as 15 seconds; Browse local items for sale. Best Apps for Selling Stuff Locally Before Moving to a New House · 1. Carousell · 2. LetGo · 3. OfferUp · 4. CPlus for Craigslist · 5. Facebook · 6. eBay · 7. You can likely obtain more money selling your items on your own either locally or using an online sales platform, such as eBay, but Decluttr is the easiest of. 5miles is designed for local use. It displays items for sale based on your location, from cars to furniture to appliances. Safety is a priority on the site, and.

20 Websites to Sell Stuff Locally and Online · Craigslist is a longstanding online marketplace that connects people locally to buy, sell, and exchange goods and. 20 Websites to Sell Stuff Locally and Online · Craigslist is a longstanding online marketplace that connects people locally to buy, sell, and exchange goods and. 15 Best Websites to Sell Stuff Locally and Make Fast Cash · Facebook Groups are another place you can sell locally. · OfferUp is another online marketplace and. Nextdoor is a great place to buy and sell items to your neighbors. Read on to learn how to sell or giveaway items on Nextdoor. Web; iPhone; Android. 1. On the. 6 apps to sell stuff locally (with pros and cons) · 1. OneRoof · 2. Decluttr · 3. Facebook · 4. OfferUp · 5. 5Miles · 6. Poshmark. Discover unique items, from home decor to trendy fashion. You never know what you'll find and fall in love with thousands of items from your local neighborhood. You can likely obtain more money selling your items on your own either locally or using an online sales platform, such as eBay, but Decluttr is the easiest of. Got used stuff? Our 5-Star ReSellas will sell things for you on sites like eBay, Craigslist, Facebook, OfferUp and Poshmark. As we've discussed, Letgo is definitely one of the most popular apps available for selling your stuff locally. Avoid Shipping. There are so many marketplaces. OfferUP is a great app that connects you with local buyers so you can sell items locally. OfferUP allows you to sell stuff online with listings for everything. Sell your stuff and bag a bargain. Whatever it is. Shpock it. Join the marketplace that makes second hand feel like a joy. Buy and sell, near and far - with. I went back to craiglist but not all items sell well on there. Still using OfferUp atleast for now view counts are better. For low ticket items. Top 9 Local Online Marketplaces For Selling Stuff · 1. Carousell · 2. Craigslist · 3. eBay · 4. Poshmark · 5. Facebook Marketplace · Decluttr · Flyp · OfferUp. Apps For Selling Stuff In Your Neighborhood · 9. Letgo · Facebook Marketplace · VarageSale · OfferUp · 5miles · Carousell · Shpock · Check out these awesome apps that make it super easy. Whether you're a fan of LetGo's sleek interface, OfferUp's negotiation potential, or the vast reach of. Facebook Marketplace - best for nearby customer connections; OfferUp - best for fee-free local selling; Poshmark - best for fashion item sales and parties; The. As a free mobile classified app, Letgo allows users to buy, sell, and chat locally. It supports both iOS and Android platforms and boasts over million. 5miles is designed for local use. It displays items for sale based on your location, from cars to furniture to appliances. Safety is a priority on the site, and. Developed as a locally-driven platform, OfferUp is another good bet for selling used things. It allows you to sell to someone local, or ship an item to a buyer.

Fastest Way To Send Money To Bank Account

PayPal. PayPal lets you send, request or collect money online or with the PayPal app. You can also shop online with a PayPal credit, debit or prepaid card. Zelle® is a way to send money directly to almost any bank account in the U.S.-typically within minutes. With an email address or U.S. mobile phone number, you. Wire transfers are usually same day transfers. An hour to set things up, and 2 or 3 hours to actually execute. Wire transfers are good funds. The fastest way to send money cross-border. This quick and easy foreign Send up to $25, USD in a single money transfer through online banking or the RBC. Online money transfer in 4 easy steps · 1. Add the recipient's info. Fill out the name, address, and phone number of your receiver. · 2. Add payment information. If you don't have a bank account, you can use a money transfer service (such as Western Union or Moneygram) and pay in cash. The funds will be then forwarded as. 1. To transfer money to another bank, start by logging in or signing up and verify your free profile. · 2. Enter the destination and amount you'd like to send. Bank transfers are a fast and convenient way to get your money from point A to point B electronically. These types of transfers can be done through wire. The apps of most major banks, for example, include Zelle®, a fast and safe way to send money to friends and family. PayPal. PayPal lets you send, request or collect money online or with the PayPal app. You can also shop online with a PayPal credit, debit or prepaid card. Zelle® is a way to send money directly to almost any bank account in the U.S.-typically within minutes. With an email address or U.S. mobile phone number, you. Wire transfers are usually same day transfers. An hour to set things up, and 2 or 3 hours to actually execute. Wire transfers are good funds. The fastest way to send money cross-border. This quick and easy foreign Send up to $25, USD in a single money transfer through online banking or the RBC. Online money transfer in 4 easy steps · 1. Add the recipient's info. Fill out the name, address, and phone number of your receiver. · 2. Add payment information. If you don't have a bank account, you can use a money transfer service (such as Western Union or Moneygram) and pay in cash. The funds will be then forwarded as. 1. To transfer money to another bank, start by logging in or signing up and verify your free profile. · 2. Enter the destination and amount you'd like to send. Bank transfers are a fast and convenient way to get your money from point A to point B electronically. These types of transfers can be done through wire. The apps of most major banks, for example, include Zelle®, a fast and safe way to send money to friends and family.

Peer-to-peer payment apps, wire transfers and paper checks are other ways to transfer money between bank accounts. Looking at speed, cost and transfer limits. Now, you can also send money to US bank accounts from the USA and beyond. Save your friends and family time when you send online wire transfer directly to their. A wire transfer would be your best bet. Safe. Fixed price (regardless of how much amount you transfer) and its secure. Both parties can be. For transferring money, all you need to do is link your bank account and choose your recipient — they'll have the money in minutes. Like most third-party money. There are many ways to do this, including using your bank's website or mobile app, a personal check, a cashier's check, a wire transfer or an ACH transaction. Banks may send account information, notifications, and transaction requests over bank wire. This is the fastest way to send money, as funds are typically. If you don't have a bank account, you can use a money transfer service (such as Western Union or Moneygram) and pay in cash. The funds will be then forwarded as. This lets you easily send money online to someone else's account, and is also a great way to transfer money between your own accounts with Bank of America or at. Instant transfers. The quickest way to get your money. For a fee, instantly transfer money to your external bank account, or set up a same-day. The fastest way to send money cross-border. This quick and easy foreign Send up to $25, USD in a single money transfer through online banking or the RBC. Zelle®: A fast and easy way to send money · There are no fees to send or receive money in our app · Money moves directly to their account in minutes · You only. However, if you don't mind paying for the convenience, PayPal's Instant Transfer is an easy method to send money to a bank account instantly. Zelle. Zelle is a. Which is the fastest way to send money abroad? · Direct Debit · Debit Card · Credit Card · Apple Pay · Google Pay · Wise account · Bank Transfer. With the introduction of Automatic Bank Transfers, you only need to log into your online banking platform through the WorldRemit app, and input payee and. Not mentioned in all the other answers below and is probably just as fast and easy, and if your target bank has a mobile app with remote deposit. Cash is another option for transferring money, as it is free to withdraw money from one bank and make a deposit at the bank where the recipient has a checking. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer in minutes using the U.S. Bank Mobile App or online banking. Terms and conditions apply. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your. If you need to send a large amount of cash quickly, a bank wire transfer is a worthwhile option. You can move thousands of dollars within a matter of minutes or. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer in minutes using the U.S. Bank Mobile App or online banking.

Home Depot Credit Services Pay Bill

Home Depot Credit Services P.O. Box St. Louis, MO Payment Addresses. Payment Addresses. The Home Depot® Commercial Account Payments Home Depot. No, you will not go to jail for not paying your credit card bill. The US did away with debtor's prisons more than yeas ago. You cannot be. Same Day Crediting. The payment cutoff time for Online Bill and Phone Payments is midnight ET. This means we will credit your account as of the calendar day. Home Depot is refusing to take payments and accusing the customer of not paying their Pro Xtra card bills. A certain customer has filed. 5% Off Every Day or 6 Months Special Financing or 84 Fixed Monthly Payments. CREDIT FINANCING PROMOTION DETAILS: Offers subject to credit approval. Special. Need Help? Call , TTY: Use or other Relay Service. How can I pay my bill immediately? To make online payments at no charge, click the Payments menu, then click the link to add a payment account or make a payment. ✓ Use it with Home Depot online, in-store and for Home Services^. Calculate Your Monthly Payment. Home Depot offers convenient, affordable, credit card options to extend their purchasing power as well as manage and pay their account. Home Depot Credit Services P.O. Box St. Louis, MO Payment Addresses. Payment Addresses. The Home Depot® Commercial Account Payments Home Depot. No, you will not go to jail for not paying your credit card bill. The US did away with debtor's prisons more than yeas ago. You cannot be. Same Day Crediting. The payment cutoff time for Online Bill and Phone Payments is midnight ET. This means we will credit your account as of the calendar day. Home Depot is refusing to take payments and accusing the customer of not paying their Pro Xtra card bills. A certain customer has filed. 5% Off Every Day or 6 Months Special Financing or 84 Fixed Monthly Payments. CREDIT FINANCING PROMOTION DETAILS: Offers subject to credit approval. Special. Need Help? Call , TTY: Use or other Relay Service. How can I pay my bill immediately? To make online payments at no charge, click the Payments menu, then click the link to add a payment account or make a payment. ✓ Use it with Home Depot online, in-store and for Home Services^. Calculate Your Monthly Payment. Home Depot offers convenient, affordable, credit card options to extend their purchasing power as well as manage and pay their account.

*On approved credit by FinanceIt Canada Inc. as agent for a third-party financial institution. Principal only payments of % required during the 6-month. To stupid to pay credit card, must complain to people. About halfway down the app there's a damn button that says “Home Depot Credit Card” if. The Home Depot Consumer Credit Card is an ideal addition to any toolbox. Open an account today and enjoy No Interest If Paid in Full Within 6 months. Their online system is horrible!! I had trouble just creating an account to PAY MY BILL and their operators could not even help with that. The interest rate. Visit the Home Depot Credit Cards page to pay and manage your card. You haven't saved any credit cards. Add a credit card for quick and easy checkout the next. Pay your Wells Fargo Bank, N.A. credit card bill online, review your statement guide, find answers to your questions, or locate your credit card account. If you can pay your Home Depot bill off in 6 months, you'll pay no interest. Compare the interest savings to the rewards you could earn to see which is better. Products · Pricing & Payment · Pick-Up & Delivery · Installation & Services · Call Us · Mail Us · Cookies on baton-rouge-tree-services.site · Cookie Preferences. Pay your The Home Depot Card (Citi) bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple. Never miss a payment again with our free Auto-Pay automatic monthly payments feature. Click here and follow the easy directions or call us at Choose to pay your bill You can avoid interest charges for your Home Depot Consumer Credit Card by paying your balance in full by your card's due date. Home Depot Credit Services P.O. Box St. Louis, MO Payment Home Depot Credit Services Overnight Delivery/Express Payments Attn: THD. You can pay check, debit card, or cash. If you receive a bill with a barcode on it you can bring that to checkout and get your information that. Bring your monthly statement or The Home Depot Credit Card to you local The Home Depot store to make a payment in-store. You can mail in your payment to the. You can manage your RBC credit card anytime, anywhere with RBC Online Banking. Pay your bill right away or set up automated recurring payments. Just call How To Make a Home Depot Credit Card Payment by Mail. You can send your payment through the mail using the. Whether you want to check your online order status, manage your Home Depot credit card or check your Home Depot gift card balance, our online Help Center. You can apply online through the Home Depot website or in-store at any Home Depot location. You'll need to provide personal information, including your Social. The Home Depot Consumer Credit Card is an ideal addition to any toolbox. Open an account today and enjoy No Interest If Paid in Full Within 6 months. Send Notice of Billing Errors and Customer Service Inquiries to: HOME DEPOT CREDIT SERVICES period. PO Box , St. Louis, MO Amount to pay to.

How Do I Add Money To My Chime Debit Card

Providing your credit card company allows cash advances via ATM withdrawal, you could then deposit the cash into a brick and mortar bank account. in the United States. com · retail locations with our cash · Check Deposit and pick the · Serve to Chime, log in · into your Chime Checking Account · tap. The only. You can link an external bank account you own to your Chime Checking Account in the Move Money section of the Chime app or by logging into your account online. How do I earn Debit Card Cashback Bonus with my Discover Cashback Debit Account? You may earn 1% cash back on up to $3, in debit card purchases each month*. When do I receive my Chime Visa® Debit Card after I open a Chime Checking Account? How do I deposit money to my Chime Checking Account? Direct deposit. Sign in to our mobile app and deposit a check in a few simple steps. You can also visit a local branch or ATM. Debit card users can simply call customer services of the bank or prepaid debit that issued the card and perform the transfer over the phone. Just hand the cashier your cash, they'll swipe your card, and your money will load automatically. Retail service fee of up to $ applies. On the following page, click on "Transfer to Your Bank." 5. Select your Chime account as the destination bank account. You may need to provide. Providing your credit card company allows cash advances via ATM withdrawal, you could then deposit the cash into a brick and mortar bank account. in the United States. com · retail locations with our cash · Check Deposit and pick the · Serve to Chime, log in · into your Chime Checking Account · tap. The only. You can link an external bank account you own to your Chime Checking Account in the Move Money section of the Chime app or by logging into your account online. How do I earn Debit Card Cashback Bonus with my Discover Cashback Debit Account? You may earn 1% cash back on up to $3, in debit card purchases each month*. When do I receive my Chime Visa® Debit Card after I open a Chime Checking Account? How do I deposit money to my Chime Checking Account? Direct deposit. Sign in to our mobile app and deposit a check in a few simple steps. You can also visit a local branch or ATM. Debit card users can simply call customer services of the bank or prepaid debit that issued the card and perform the transfer over the phone. Just hand the cashier your cash, they'll swipe your card, and your money will load automatically. Retail service fee of up to $ applies. On the following page, click on "Transfer to Your Bank." 5. Select your Chime account as the destination bank account. You may need to provide.

Ways to load & unload money · Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal. To move money from Chime to Cash App, add your Chime debit card to Cash App. · You can also link your Chime bank account to Cash App to spend your funds with. Add Card to Apple Pay®, Samsung Pay® or Google Pay™ for contactless The Money Network Card is accepted everywhere Visa debit cards are accepted. Pick from dozens of coins, access money instantly, without any trading fees, all without switching apps. The Current Visa® Debit Card issued by Choice. If you link a debit card you enter the actual card information and it'll run a charge to that card and apply the amount to your Chime. You can also use your debit card online to make payments and to also buy money orders at the U.S. Post Office. Will my Social Security, Supplemental. Choose whether to pay with your credit3/debit card or with your bank account. Confirm, send and track your transfer. Now your money is on its way and can. To add a debit card to Chime, use the app to navigate to Move Money > Transfer from Other Banks, enter your bank's credentials, and verify your identity. my Wisely card to my bank account or an external debit card? Can my secondary member add any other funds to the card? How do I add cash to my card? How do. Sign in to our mobile app and deposit a check in a few simple steps. You can also visit a local branch or ATM. Conclusion · Open the Chime app and go to the "Move Money" section. · Select the option to transfer money to an external account or debit card. How to Send Money to Chime from a Debit Card Sending money to a Chime account from a debit card directly is not typically possible; however. Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to. my Chime account with no issues. View Best Answer >. Reply. 1 Like And also is it possible to link a debit card issued by these banks for instant transfer as. Method 3: Use Your Chime Debit Card · Open Cash App and click “Banking.” · Select “Add Debit Card” and enter your Chime details. · Confirm the link between your. then tap Card Details the card details button. On iPad: Open the Settings app, tap Wallet & Apple Pay, then tap your Apple Cash card. Choose whether to pay with your credit3/debit card or with your bank account. Confirm, send and track your transfer. Now your money. Select Pay & Transfer then Transfer between my accounts. Do more with Mobile & Online Banking. Chat with. Erica · Set up custom alerts · Debit card lock/. To add a debit card to Chime, use the app to navigate to Move Money > Transfer from Other Banks, enter your bank's credentials, and verify your identity. Transfer money from an external account · Select the Move Money tab. · Tap the Transfer money button to go to the Transfer screen. · Select your account from the.

Betterment Vs Wealthfront Review

Betterment has a simpler signup process. Both firms invest it in a well-balanced mix of low-fee index funds on your behalf. But Wealthfront grills you with a. Wealthfront's management fee is a low %, which is comparable to Betterment's services. You can check out Benzinga's full comparison of Betterment vs. In conclusion, they are both great robo-investing services, but Betterment has a slight edge over Wealthfront. Comparison Corner. Find out how Betterment and. We recommend that clients review their Risk Score annually and only consider updating it every three years or so, or if they experience a significant change in. Whether you're investing for day-to-day spending or long-term retirement planning, Betterment has a portfolio option to satisfy your needs. As with Wealthfront. One thing this isn't is a referendum on which service can make the most money. Betterment and Wealthfront have a slightly different asset allocation based on. Wealthfront is cheaper at each, or equal to Betterment for values under $k. After that Wealthfront is cheaper. Regardless of your amount. Wealthfront is our most recommended robo-advisor both for beginning investors with goals to experienced investors looking for a passive option. There's a higher. Wealthfront vs Betterment ; Pros: Minimal opening deposit & fees; Advanced goal tracker; Tax loss harvesting. Cons: No human advisors; No fractional shares ; Pros. Betterment has a simpler signup process. Both firms invest it in a well-balanced mix of low-fee index funds on your behalf. But Wealthfront grills you with a. Wealthfront's management fee is a low %, which is comparable to Betterment's services. You can check out Benzinga's full comparison of Betterment vs. In conclusion, they are both great robo-investing services, but Betterment has a slight edge over Wealthfront. Comparison Corner. Find out how Betterment and. We recommend that clients review their Risk Score annually and only consider updating it every three years or so, or if they experience a significant change in. Whether you're investing for day-to-day spending or long-term retirement planning, Betterment has a portfolio option to satisfy your needs. As with Wealthfront. One thing this isn't is a referendum on which service can make the most money. Betterment and Wealthfront have a slightly different asset allocation based on. Wealthfront is cheaper at each, or equal to Betterment for values under $k. After that Wealthfront is cheaper. Regardless of your amount. Wealthfront is our most recommended robo-advisor both for beginning investors with goals to experienced investors looking for a passive option. There's a higher. Wealthfront vs Betterment ; Pros: Minimal opening deposit & fees; Advanced goal tracker; Tax loss harvesting. Cons: No human advisors; No fractional shares ; Pros.

For more information, see more reviews at the App Store and Google Play Store. Betterment LLC was recognized as the Best Overall Robo Advisor for by the. Separately, Betterment charges % on top of the ETF fees (at $, invested or above) where as Vanguard charges 0%. Vanguard does offer a similar service. If you set up auto deposits from your checking account or direct deposit; Wealthfront will continue to invest your assets for you, in line with your goals. As a robo-advisor, Betterment simplifies the investment process by automatically creating a diversified, flexible portfolio based on your financial goals and. Betterment seems to win in several aspects: minimum deposits, fees, human assistance, and fractional shares. In the battle of Acorn vs Betterment, for the average investor Betterment is the clear winner. Although Acorns may seem cool and fun because of its Round-Up. M posts. Discover videos related to Betterment Vs Wealthfront Hysa on TikTok. See more videos about Betterment Vs Wealthfront Wealth Front Hysa Review · Ally. Wealthfront is better than Betterment in some aspects, for example, it focuses more on college funds, offers crypto funds in a basic plan, and provides a line. Compared to other robo-advisors, Betterment is more centered around goal-planning and retirement. The platform encourages users to save meaningful amounts of. The base price for investing accounts is $4/month with Betterment and you're automatically switched to a % annual fee once you meet certain thresholds. For more information, see more reviews at the App Store and Google Play Store. Betterment LLC was recognized as the Best Overall Robo Advisor for by the. Wealthfront has lower overall costs for people who just want to sit back and let computer algorithms manage their money. Investors with lots of money who feel. Wealthfront is our most recommended robo-advisor both for beginning investors with goals to experienced investors looking for a passive option. There's a higher. Compare Betterment vs. Wealthfront using this comparison chart. Compare price, features, and reviews of the software side-by-side to make the best choice. If you're looking for access to human advisors, you'll want to consider Schwab Intelligent Portfolios or SoFi Automated Investing. Betterment also offers human. Betterment Tops Wealthfront for High Balance Services · Betterment offers high balance customers access to human advisors in exchange for a slightly higher. Wealthfront isn't the only famous robo-advisor that's big on ETFs, though. The competition is fierce, and Betterment has an arguably more dominant position in. To turn off the adviser service with Betterment or Wealthfront, you would have to move your money somewhere else. The only draw back I see is that Vanguard does. Betterment has a simpler signup process. Both firms invest it in a well-balanced mix of low-fee index funds on your behalf. But Wealthfront grills you with a. Betterment is a robo advisor that is great for beginners, but advanced investors will like its many features as well. It's easy to set up, and you can get.

10k Loan 4 Years

Electronic funding to a non-U.S. Bank account requires verification and can take one to four business days. Not all loan programs are available in all states. %. And pay it back over in months. months. 4 years. Term. 1yr; 2yr; 3yr; 4yr You could borrow £10, over 48 months with 48 monthly repayments of £ Use this calculator to determine your monthly payments and the total costs of your personal loan. Loan Amount: Interest Rate: %. Term: Years. Calculate. †The information As you compare lenders and loan offers, also find out whether the loans you're. If you're looking to take out a personal loan but aren't sure how much you can afford to borrow, this personal loan calculator can help you find the answer. Let's say you want to borrow $10, to update part of your home. The lender has offered a % interest rate on a three-year loan. With those terms, you'd. Determine your estimated payments for different loan amounts, interest rates and terms with this Simple Loan Calculator. But if you take out a $15, loan for seven years with an APR of 4%, your monthly payment will be $ Almost all personal loans offer payoff periods show. Interest rate: %; Loan term: 3 years. Check your results against ours: Monthly payment: $; Total interest: $4, Debt consolidation loan. Electronic funding to a non-U.S. Bank account requires verification and can take one to four business days. Not all loan programs are available in all states. %. And pay it back over in months. months. 4 years. Term. 1yr; 2yr; 3yr; 4yr You could borrow £10, over 48 months with 48 monthly repayments of £ Use this calculator to determine your monthly payments and the total costs of your personal loan. Loan Amount: Interest Rate: %. Term: Years. Calculate. †The information As you compare lenders and loan offers, also find out whether the loans you're. If you're looking to take out a personal loan but aren't sure how much you can afford to borrow, this personal loan calculator can help you find the answer. Let's say you want to borrow $10, to update part of your home. The lender has offered a % interest rate on a three-year loan. With those terms, you'd. Determine your estimated payments for different loan amounts, interest rates and terms with this Simple Loan Calculator. But if you take out a $15, loan for seven years with an APR of 4%, your monthly payment will be $ Almost all personal loans offer payoff periods show. Interest rate: %; Loan term: 3 years. Check your results against ours: Monthly payment: $; Total interest: $4, Debt consolidation loan.

Your loan repayment term is the number of years you have to pay it back. Federal loans generally have a standard repayment schedule of 10 baton-rouge-tree-services.sitete 2. Year Table of the amounts applied to principal and interest at different intervals over the course of the loan term Principal Interest 1 2 3 4. Term in years. Loan payment. Extra payment. Total payment. Four mistakes mortgage shoppers should avoid. More from Personal Finance. On a €20, loan over 5 years, at a fixed rate of % (% APR) you will pay € a month. The total cost of credit would be €3, and the total. Apply when you're ready. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term. Use this calculator to determine your monthly payments and the total costs of your personal loan. 4 June and 27 August Comparison rates and examples are based on a $30, unsecured personal loan over 5 years and a $30, secured loan over 5. Use this loan payoff calculator to find out how many payments it will take to pay off a loan. All fields are required. Purchase price. Down. Loan term (years). 1 2 3 4 5. 6 7 8 9 The longer the loan term, the less you 4 Years. £ £12, 3 Years. £ £11, 2 Years. £ 4 0 0 0 4 1 3 2 A personal loan is a short-term, unsecured loan with terms typically ranging from 2 to 5 years. You might think you can calculate your total borrowing costs for the year by multiplying your loan amount by your APR, but because most personal loans are. (The loan calculator can be used to calculate student loan payments, auto loans or to calculate your mortgage payments.) Loan Term (Years) *. Loan Fees. %. Save on higher-rate debt with a fixed interest rate from % to % APR. Flexible Terms. Borrow up to $40, and repay it over 3 to 7 years —. Our handy Personal Loan Calculator can help you calculate estimated monthly payments. Interested in getting a personal loan? Use Upstart's loan calculator to get an estimate of your monthly payments and total interest costs. SBA Loan Types. The SBA offers four types of small business loans: 7(a) Loan They may take out loans as large as $5 million for up to 10 years for working. Or, enter in the loan amount and we will calculate your monthly payment. You can then examine your principal balances by payment, total of all payments made. Use this monthly payment calculator to determine payments on fixed term or line of credit loans. Personal Loan Payment Calculator More frequent payments will reduce your total interest over the term of your loan. I'll pay it off in. 3 years, 4 years. Use Bank of America's auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan.

Is 4.5 A High Mortgage Rate

When many prices are rising quickly, the rate of inflation is high. It Higher interest rates mean higher payments on many mortgages and loans. So. Interest is what you pay for borrowing money, and what banks pay you for saving money with them. Interest rates are shown as a percentage of the amount you. See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. Since higher mortgage rates make homebuying more expensive For example, say you decide to buy a $, home when the average interest rate is %. Yes it is. For the past year % was about the average rate, however due to the Federal Reserves' announcement of no further rate increase mortagage rates. mortgage rate of % fixed for another years? I appreciate the fees of rising interest rates, high volatility and inflation. This needs to be. Find and compare year mortgage rates and choose your preferred lender. Check rates today to learn more about the latest year mortgage rates. In contrast, the average rate on a year fixed mortgage is %, more than 1% higher than the rate on a 5/1 ARM. “In this high-interest rate environment. This means that the cost of borrowing money to buy a house is higher. Conversely, you are more likely to be offered a lower interest rate if you have a high. When many prices are rising quickly, the rate of inflation is high. It Higher interest rates mean higher payments on many mortgages and loans. So. Interest is what you pay for borrowing money, and what banks pay you for saving money with them. Interest rates are shown as a percentage of the amount you. See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. Since higher mortgage rates make homebuying more expensive For example, say you decide to buy a $, home when the average interest rate is %. Yes it is. For the past year % was about the average rate, however due to the Federal Reserves' announcement of no further rate increase mortagage rates. mortgage rate of % fixed for another years? I appreciate the fees of rising interest rates, high volatility and inflation. This needs to be. Find and compare year mortgage rates and choose your preferred lender. Check rates today to learn more about the latest year mortgage rates. In contrast, the average rate on a year fixed mortgage is %, more than 1% higher than the rate on a 5/1 ARM. “In this high-interest rate environment. This means that the cost of borrowing money to buy a house is higher. Conversely, you are more likely to be offered a lower interest rate if you have a high.

Interest rates are still very low and are only likely to go higher. Wish you the best.

Earlier this month, rates plunged and are now lingering just under percent, which has not been enough to motivate potential homebuyers. Rates likely will. If your interest rate is % or lower4, you may want to focus on investing. Also, remember that credit cards and personal loans commonly come with high. The average weekly rate for a year, fixed-rate mortgage reached a year high at % at the end of October and has been tumbling since. That brings the. If interest rates drop to % this year you're going to be competing with 5x people for every 1 in the market right now. The same loan at a % interest rate would have a monthly payment of $ per month*. That $17 per month savings might seem really attractive at first, but. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. % for Year 1 One caveat: Lower monthly payments represented in a year mortgage will be accompanied by higher interest rates and more interest rate. There's a lot of hype these days about interest rates climbing, but the truth is mortgage rates are the lowest they have been in decades. What is a good mortgage rate? A 'good' mortgage interest rate is typically between %. However, whether mortgage lenders are offering rates between this. Higher interest rate. Because the lender is tying up its money longer, year fixed mortgage rates are higher than on loans with shorter terms, such as If you have to pay an interest rate of The total cost of your mortgage will also be $83, higher than the loan with the lower interest rate. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Additionally, the interest rate for a year fixed mortgage is at %, compared to % a week ago and up from % last year. This is higher than the long. "Do you have a fixed rate mortgage? Or a variable rate mortgage? What is your renewal date? What is your current interest rate? How much will you still owe on. Large Financial Institutions · Foreign Banking Organizations Prime is one of several base rates used by banks to price short-term business loans. loan rates: %, %, or %. Cost to Payoff Mortgage 10 Years Early and If it's expensive debt (that is, with a high interest rate) and you. In addition, making too low a down payment (which is also seen as risky) can result in the borrower receiving a higher interest rate. Choosing a shorter loan. Taxpayers can deduct the interest paid on first and second mortgages up to $1,, in mortgage debt (the limit is $, if married and filing separately). What is the interest rate and payback period? How much down payment is required? No down payment is typically required. Applicants with assets higher than the.

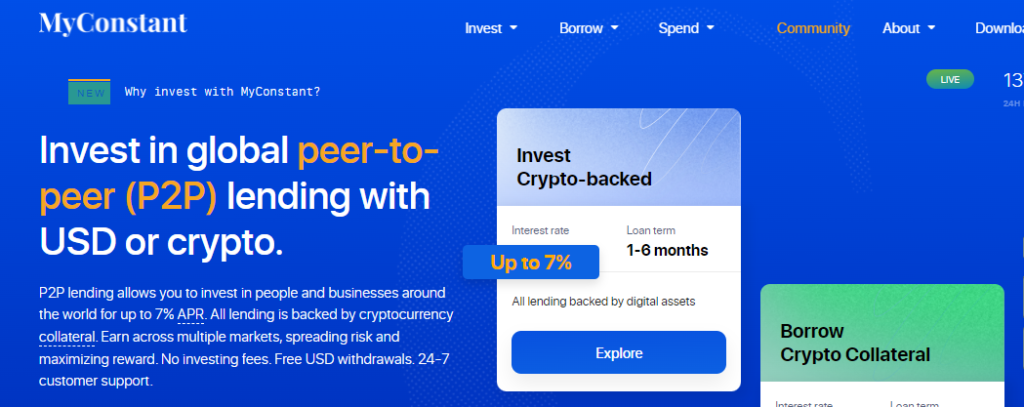

Myconstant

MyConstant is a financial platform offering a series of crypto investment and lending products which supports over 80 cryptocurrencies. MyConstant Overview · baton-rouge-tree-services.site · Riverside, CA · 1 to 50 Employees · Type: Company - Private · Revenue: Unknown / Non-Applicable. Competitors. MyConstant is a peer2peer lending company. I deposited $ in USDC coin a crypto currency tied to the US dollar. Icon for MyConstant · MyConstant. A peer-to-peer lending platform connecting investors directly with borrowers. Follow. Profile photo for Kathy Nguyen. Sign up and borrow today to get a MyConstant 0% APR for your loan order. After you sign up, 0% APR is auto applied to your first loan day term so you can. Listen to Alternative Investing with MyConstant on Spotify. Join Chris Roper and Trevor Kraus of MyConstant (an asset-backed P2P lending platform) as they. Do you agree with MyConstant's 4-star rating? Check out what people have written so far, and share your own experience. Try MyConstant Peer-To-Peer Lending United States today! Get a better return on your money. Earn up to 9% APR by investing in P2P loans to people a. MyConstant Employee Directory. Financial ServicesCalifornia, United States Employees. Fully-secured, non-custodial, peer-to-peer lending platform that. MyConstant is a financial platform offering a series of crypto investment and lending products which supports over 80 cryptocurrencies. MyConstant Overview · baton-rouge-tree-services.site · Riverside, CA · 1 to 50 Employees · Type: Company - Private · Revenue: Unknown / Non-Applicable. Competitors. MyConstant is a peer2peer lending company. I deposited $ in USDC coin a crypto currency tied to the US dollar. Icon for MyConstant · MyConstant. A peer-to-peer lending platform connecting investors directly with borrowers. Follow. Profile photo for Kathy Nguyen. Sign up and borrow today to get a MyConstant 0% APR for your loan order. After you sign up, 0% APR is auto applied to your first loan day term so you can. Listen to Alternative Investing with MyConstant on Spotify. Join Chris Roper and Trevor Kraus of MyConstant (an asset-backed P2P lending platform) as they. Do you agree with MyConstant's 4-star rating? Check out what people have written so far, and share your own experience. Try MyConstant Peer-To-Peer Lending United States today! Get a better return on your money. Earn up to 9% APR by investing in P2P loans to people a. MyConstant Employee Directory. Financial ServicesCalifornia, United States Employees. Fully-secured, non-custodial, peer-to-peer lending platform that.

View MyConstant (baton-rouge-tree-services.site) location in California, United States, revenue, competitors and contact information. Find and reach MyConstant's. MyConstant Employee Directory. Financial ServicesCalifornia, United States Employees. Fully-secured, non-custodial, peer-to-peer lending platform that. MyConstant Affiliate Program - Is It Legit or Scam? Check out real reviews, payment proofs, affiliate program details about MyConstant Affiliates at. Find MyConstant's most common email address formats to build your pipeline with confidence. Get accurate & updated contact data with LeadIQ. MyConstant (MCT) is a utility token issued on the Binance Smart Chain (BSC) that powers a collateral-backed peer-to-peer lending platform. MyConstant Guarantee - Scope of Protection. MyConstant is committed to protecting you from loss or theft of cash and cryptocurrency assets while in our. MyConstant is a leading peer-to-peer lending platform in the USA, offering innovative investment opportunities for both USD and Crypto. MyConstant membership program. We always listen to our users, so we have MCT (MyConstant Token) is a digital token native to the MyConstant platform. Summary: I have been lending my stable coins on MyConstant since beginning of I have no withdrawal or security issues so far. Positive: I have been. MyConstant (MCT) is a digital asset with the market capitalization of $M. MyConstant is ranged as in the global cryptocurrency rating with an. Download MyConstant–Secured P2P lending APK for Android right now. No extra costs. User ratings for MyConstant–Secured P2P lending: 0. Do you agree with MyConstant's 4-star rating? Check out what people have written so far, and share your own experience. | Read Reviews out of. MyConstant Overview · baton-rouge-tree-services.site · Riverside, CA · 1 to 50 Employees · Type: Company - Private · Revenue: Unknown / Non-Applicable. Competitors. 10 votes, 18 comments. MyConstant is unable to continue to operate our business as usual. As such, we're pausing customer withdrawals as. Get the latest MyConstant price, MCT market cap, charts and data today. The live MyConstant price today is $ with a market cap of M and a hour. Best MyConstant Alternatives in · Nexo · Abra · YouHodler · Coinbase · BlockFi · Vauld · Matrixport · Hodlnaut. MyConstant Abrupt Cease Operations Backlash and Accusations. MyConstant faced severe backlash from users as they ceased operations abruptly. Download MyConstant–Secured P2P lending APK for Android right now. No extra costs. User ratings for MyConstant–Secured P2P lending: 0. MyConstant is a financial platform offering a series of crypto investment and lending products which supports over 80 cryptocurrencies. View MyConstant (baton-rouge-tree-services.site) location in California, United States, revenue, industry and description. Find related and similar companies as well.