baton-rouge-tree-services.site

Learn

Mortgage For Excellent Credit

The credit score you'll need to buy a house depends on the type of mortgage you're applying for. Learn what loans are best for certain credit ranges here. Adjustments to the terms available for most loan programs occur in 20 point increments. For example the second best credit score range would be , then. How good is an credit score? Lenders tend to evaluate credit scores in ranges, and a credit score between and falls in the "excellent" range. What is a good credit score to get a mortgage? ; Excellent You could be in line for the best mortgage deals with lower interest rates ; Good - A score of or above is generally considered very good, but you don't need that score or above to buy a home. Credit scores are maintained by the national. A score of or higher is considered good. Lenders differ, but they generally want to see a score of at least before offering most home loans. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Mortgage lenders are getting stricter, but you still don't need a perfect credit score. CNBC Select spoke with experts to learn what credit score you. In this article we're going to compare mortgage lenders for high credit scores and what key attributes you should look for when deciding which lender to choose. The credit score you'll need to buy a house depends on the type of mortgage you're applying for. Learn what loans are best for certain credit ranges here. Adjustments to the terms available for most loan programs occur in 20 point increments. For example the second best credit score range would be , then. How good is an credit score? Lenders tend to evaluate credit scores in ranges, and a credit score between and falls in the "excellent" range. What is a good credit score to get a mortgage? ; Excellent You could be in line for the best mortgage deals with lower interest rates ; Good - A score of or above is generally considered very good, but you don't need that score or above to buy a home. Credit scores are maintained by the national. A score of or higher is considered good. Lenders differ, but they generally want to see a score of at least before offering most home loans. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Mortgage lenders are getting stricter, but you still don't need a perfect credit score. CNBC Select spoke with experts to learn what credit score you. In this article we're going to compare mortgage lenders for high credit scores and what key attributes you should look for when deciding which lender to choose.

A credit score above is considered excellent and gets you the best home loan rates, according to the online financial site NerdWallet. This number signals to lenders that you're a low risk for defaulting on your mortgage, making you a good candidate for a home loan. Qualifying for a mortgage is. Homebuyers need a minimum credit score of for approval. If your score is below this benchmark, you are unlikely to qualify for a conventional loan. Assuming that's all true, and you're within the realm of financial reason, a should be enough to get you a loan. Anything lower than and all bets are. Most loans require a credit score of or higher to qualify, though certain loan types are more lenient toward lower credit scores (more on that later). A. They include your loan amount, how much debt you have compared to your income and your credit profile. Our experts use this info to find the best rate for you –. What credit score is needed to buy a house and get the best mortgage rate? · is the new benchmark for the lowest rates. · to credit scores get a break. A score of or higher is considered good. Lenders differ, but they generally want to see a score of at least before offering most home loans. A good credit score is definitely an important factor for anyone, who wants to be approved for a mortgage. However, it's far from being the only. is the benchmark for prime credit on a mortgage (it was forever but this spring they changed it to ). The difference between and. In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. 3. FHA Loan. FHA loans are insured by the Federal Housing Administration and issued by approved lenders. They're intended for homebuyers with low income or. is the benchmark for prime credit on a mortgage (it was forever but this spring they changed it to ). The difference between and. A credit score between and is still considered good. You can still qualify for a mortgage with a Prime lender but may not qualify for the best rates or. A mortgage is a loan from a bank or lender for the purpose of buying a house or other real estate. Banks and lenders need to know that you'll be able to pay. In today's market, a good mortgage interest rate can fall in the low-6% range, depending on several factors, such as the type of mortgage, loan term, and. CNBC Select rounded up lenders that may be best for those with average or fair credit scores and evaluated each lender based on the types of loans offered. Credit score requirements for conventional loans vary by lender but tend to require a minimum of With this loan program, it's expected you have a good. A conventional loan one that is not backed by the federal government. Borrowers with very good credit, stable employment and income histories, and the ability. How does a credit score impact my mortgage qualification? · A score of + is considered “excellent” and you can expect to qualify for the best rates. · A score.

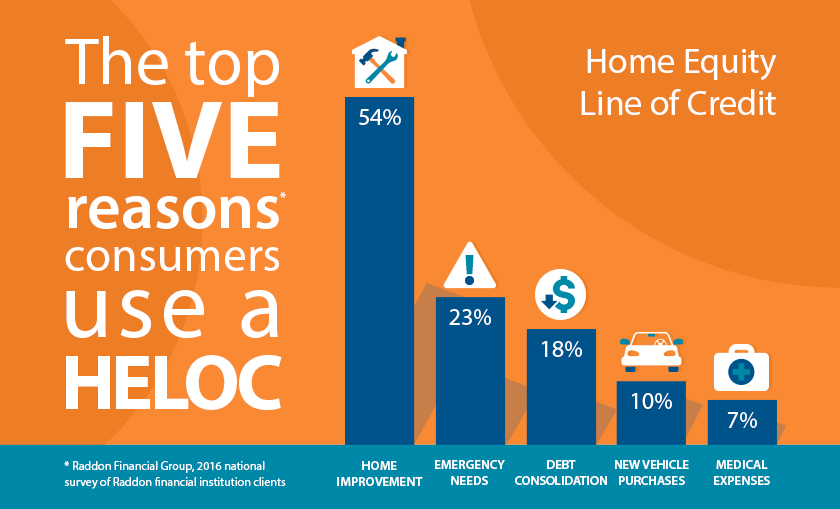

Home Equity Line Of Credit Best Lenders

Home equity lending Turn your home's equity into opportunity. Remodel Excellent credit is required to qualify for the lowest rates. Apply for a HELOC. Best Home Equity Loan Rates ; Navy Federal, %, $10, ; Discover, %, $35, ; Citi Bank, % – %, $25, ; BBVA Compass, % – %, $10, With a Bank of America HELOC, there are no closing costs, no application fees, no annual fees, and no fees to use the funds. Plus, Bank of America offers rate. Whatever you're looking to do, one of the best ways to improve your home is with a HELOC. With a Home Equity Line of Credit, you can borrow against your home's. Quorum's HELOC solutions feature low loan rates with generous discounts, flexible terms, transparent fees, commonsense underwriting, and a seamless online. Home Equity Loan Canada. Whether you need $10, or $, – Alpine Credits is the best alternative to banks for home equity loans in Canada. Apply now. When interest rates are high or rising, a HELOC may be the best way to access your home's equity. Compare the best HELOC loans on the market, and find the. A home equity loan offers borrowers a lump sum with an interest rate that is fixed, but tends to be higher. HELOCs, on the other hand, offer access to cash on. A home equity loan and a HELOC differ in how credit is provided and the type of interest rate involved. Home equity lending Turn your home's equity into opportunity. Remodel Excellent credit is required to qualify for the lowest rates. Apply for a HELOC. Best Home Equity Loan Rates ; Navy Federal, %, $10, ; Discover, %, $35, ; Citi Bank, % – %, $25, ; BBVA Compass, % – %, $10, With a Bank of America HELOC, there are no closing costs, no application fees, no annual fees, and no fees to use the funds. Plus, Bank of America offers rate. Whatever you're looking to do, one of the best ways to improve your home is with a HELOC. With a Home Equity Line of Credit, you can borrow against your home's. Quorum's HELOC solutions feature low loan rates with generous discounts, flexible terms, transparent fees, commonsense underwriting, and a seamless online. Home Equity Loan Canada. Whether you need $10, or $, – Alpine Credits is the best alternative to banks for home equity loans in Canada. Apply now. When interest rates are high or rising, a HELOC may be the best way to access your home's equity. Compare the best HELOC loans on the market, and find the. A home equity loan offers borrowers a lump sum with an interest rate that is fixed, but tends to be higher. HELOCs, on the other hand, offer access to cash on. A home equity loan and a HELOC differ in how credit is provided and the type of interest rate involved.

An Equitable Bank Home Equity Line of Credit (HELOC) helps you borrow at a low interest rate with payments as low as interest only. home equity loan or HELOC is the best option. At baton-rouge-tree-services.site, we specialize in connecting individuals with bad credit to lenders who offer home equity loans. A Home Equity Line of Credit (HELOC) allows you to establish a line of Best of all, there are no closing costs, no annual maintenance fees and no. Home equity is the difference between your home's market value and the amount you owe on your mortgage. With a Horizon Bank Home Equity Line of Credit or Term. Best HELOC lenders · Bank of America: Best overall. · Connexus Credit Union: Best for low introductory rates. · Flagstar: Best for closing discounts. · PenFed. Get access to a line of credit you can use to fund renovations, home improvements, big expenses, and more. Home equity loans tend to have considerably lower interest rates than credit cards or personal loans, which are generally not secured. Turn your home equity into cash with a Homeowner's Line of Credit. Access up to 65% of your home's value to take care of extensive renovations. Both of these loans are tied to your Versatile Line of Credit and are part of the same mortgage. Why choose a HELOC? Benefit from a good interest rate. When. Whether you're getting your feet wet or diving in the world of loans, a HELOC is often a prime choice for borrowers. And the crown molding on top? You can often. Low, variable rate · Competitive rates, lower than credit cards and consumer loans · Pay no closing costs and no NYS mortgage tax · A revolving line of credit. If you have property in Texas, a home equity loan or home equity line of credit (HELOC) can be an economical way to obtain a low-rate loan. Another good option is a Flex-Equity Mortgage with Meridian. It combines a regular mortgage with a Home Equity Line of Credit. As you pay down the principal of. Lenders allow total loans (mortgage plus HELOC) of up to 80% of your home's value. So, if your home is worth $, and your mortgage is $,, your HELOC. Home Equity Loans & Lines ; Highly affordable. The value of your home helps you qualify for one of the lowest loan rates around. ; Home Equity Line of Credit 80%. Credit Union in Montana providing home equity loans and lines of credit for residents of Western Montana, incl. Missoula, Anaconda, Butte & Stevensville. Home Equity Loans · Shoreham Bank $50, Home Equity Loan · Firstrust Bank $50, Home Equity Loan · South State Bank $50, HELOC · Valley Bank $50, PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. Find out if a home equity line of credit from CIBC is the right borrowing solution for you. Learn what a home equity credit line is, how it differs from an.

The Most Net Worth

Key Takeaways · The minimum net worth of the top 1% of households is roughly $ million. · An individual would have to earn an average of $, per year to. Walton is considered the richest owner in the NFL by net worth. According to Forbes, Walton's net worth is $ billion, which makes him more than twice as. Net Worth. Industry. 1. Bernard Arnault & family. $ B. up arrow. Fashion & Retail. Bernard Arnault & family. Bernard Arnault oversees the LVMH empire of Graph and download economic data for Total Net Worth Held by the Top 1% (99th to th Wealth Percentiles) (WFRBLT) from Q3 to Q1 about net. The top billionaire and world's richest individual is Bernard Arnault, overseeing the LVMH empire (including Louis Vuitton), worth $ billion. Tesla CEO Elon. So, who's the current richest rapper in Hip Hop? Ever changing, especially amid Kanye West's recent drop in net worth because of a string of controversies, the. This is a list of the wealthiest Americans ranked by net worth. It is based on an annual assessment of wealth and assets by Forbes and by data from the. By , the average wealth of Switzerland per capita totals $, Swiss billionaires who earn above this include Ernesto Bertarelli at $ billion and. The richest person in the world is Bernard Arnault; he and his family have a net worth of $ billion as of March Key Takeaways · The minimum net worth of the top 1% of households is roughly $ million. · An individual would have to earn an average of $, per year to. Walton is considered the richest owner in the NFL by net worth. According to Forbes, Walton's net worth is $ billion, which makes him more than twice as. Net Worth. Industry. 1. Bernard Arnault & family. $ B. up arrow. Fashion & Retail. Bernard Arnault & family. Bernard Arnault oversees the LVMH empire of Graph and download economic data for Total Net Worth Held by the Top 1% (99th to th Wealth Percentiles) (WFRBLT) from Q3 to Q1 about net. The top billionaire and world's richest individual is Bernard Arnault, overseeing the LVMH empire (including Louis Vuitton), worth $ billion. Tesla CEO Elon. So, who's the current richest rapper in Hip Hop? Ever changing, especially amid Kanye West's recent drop in net worth because of a string of controversies, the. This is a list of the wealthiest Americans ranked by net worth. It is based on an annual assessment of wealth and assets by Forbes and by data from the. By , the average wealth of Switzerland per capita totals $, Swiss billionaires who earn above this include Ernesto Bertarelli at $ billion and. The richest person in the world is Bernard Arnault; he and his family have a net worth of $ billion as of March

Graph and download economic data for Share of Total Net Worth Held by the Top 1% (99th to th Wealth Percentiles) (WFRBST) from Q3 to Q1 Net worth is simply everything you own, or your assets, minus everything you owe, or your debts. It is calculated by subtracting what you owe to creditors from. Comparing your own net worth to the average of other Americans in your age group can be one way to benchmark your progress and set financial goals. Richest companies by net assets ; 1, Berkshire Hathaway, $ billion ; 2, ICBC, $ billion ; 3, Saudi Aramco, $ billion ; 4, China Construction Bank. View profiles for each of the world's richest people, see the biggest movers, and compare fortunes or track returns. ; 1. Elon Musk. $B ; 2. Jeff Bezos. the most common of which is high-net-worth individual. To be in this group, you need more than $ million in net worth of $, in investable assets. Jeff Bezos, founder and CEO, rocketed up the rankings, becoming the first centibillionaire (someone with a net worth of over $ billion) in He held the. Financial planning, passive income and investing: The three ways millionaires build their net worth. Overall, to have a top 1% net worth in requires having at least $13 million according to the Federal Reserve. How the great wealth transfer might look in practice. Which of the markets we've analyzed have the most millionaires, and where they're on track to keep growing. Net worth breakdown by state It turns out that residents of Connecticut have the highest average net worth of any state in the country. The top five states in. net worth investors. Ultra Since we published our first Global Wealth Report 15 years ago, wealth in Asia-Pacific has grown the most—by nearly %. According to Credit Suisse, the wealthiest nation in the world in by net worth was the United States, with a net wealth of $ trillion. There are. Comparing your own net worth to the average of other Americans in your age group can be one way to benchmark your progress and set financial goals. Net Worth Summary. Cash. Private asset. Public asset. Misc. liabilities. Mouse over In calculating net worth, Bloomberg News strives to provide the most. Heidi Klum first made a considerable amount of money after winning a $, prize as part of a modelling contract in , yet the German-American supermodel. The net worth formula is: Assets – Liabilities = Net worth. So to calculate your net worth, add up the value of everything you own and subtract from it the. His net worth is currently estimated at $ million, with earnings of about $30 million in This is slightly less than the $35+ million income of the. The World Wealth Report reflects the views of 3, high-net-worth individuals, including 1,+ ultra-high-net-worth individuals (UHNWI);

What Happens If You Have A Lapse In Homeowners Insurance

If you let a previous homeowners policy lapse, it could hurt your chances of getting a new policy. Insurers may worry you'll let your new policy lapse, too. Should your homeowners insurance lapse, your lender may purchase insurance for your property. This is called force-placed or lender-placed insurance, and the. If your insurance lapses, this will also lead to a loss of liability coverage for every person on your property. The medical bills (for everyone injured on your. A lapse in coverage or a loss of coverage will result in a lapse penalty and fine. Notice of pending suspension will be mailed to the registered owner. What happens if I have a lapse of liability insurance? Whenever your liability coverage is cancelled or nonrenewed, your insurance company is required to. EVEN IF YOU HAVE PAID OFF YOUR MORTGAGE. CONSUMER ADVISORY. Shop around! If you have let your insurance lapse, or you are interested in shopping for a new. If you were to discover damage and it is determined the damage occurred while your insurance was lapsed it won't be covered. Hail damage, for. “However, during the lapse in coverage, any claims filed wouldn't be paid, and when there are too many lapses, even though you eventually pay, that can be. If you let your insurance lapse, your mortgage lender will likely have your home insured. If you let a previous homeowners policy lapse, it could hurt your chances of getting a new policy. Insurers may worry you'll let your new policy lapse, too. Should your homeowners insurance lapse, your lender may purchase insurance for your property. This is called force-placed or lender-placed insurance, and the. If your insurance lapses, this will also lead to a loss of liability coverage for every person on your property. The medical bills (for everyone injured on your. A lapse in coverage or a loss of coverage will result in a lapse penalty and fine. Notice of pending suspension will be mailed to the registered owner. What happens if I have a lapse of liability insurance? Whenever your liability coverage is cancelled or nonrenewed, your insurance company is required to. EVEN IF YOU HAVE PAID OFF YOUR MORTGAGE. CONSUMER ADVISORY. Shop around! If you have let your insurance lapse, or you are interested in shopping for a new. If you were to discover damage and it is determined the damage occurred while your insurance was lapsed it won't be covered. Hail damage, for. “However, during the lapse in coverage, any claims filed wouldn't be paid, and when there are too many lapses, even though you eventually pay, that can be. If you let your insurance lapse, your mortgage lender will likely have your home insured.

If you allow your homeowner's policy to lapse even for one or two days, insurance will not cover damages to your property from vandalism, burglary, a fire, or a. If you allow your homeowner's policy to lapse even for one or two days, insurance will not cover damages to your property from vandalism, burglary, a fire, or a. Lapse: When premium payments are in default, an insurance contract is canceled and is said to have “lapsed.” your lender if you default on your mortgage. However, if the policy lapses or is canceled and the borrower does not secure a replacement policy, most mortgages allow the lender to purchase insurance for. A lapse leaves you on the hook financially for any damages that occur to your home and could make it more difficult to get coverage in the future. If you let your insurance lapse, your mortgage lender will likely have your home insured. Your agent should be able to assist you if you need or desire flood. A lapse in homeowner's insurance results in a loss of financial protection if damage occurs to the home. Failure to pay the premiums or renew the policy leads. If you lose homeowners insurance, you will lose the option of receiving financial recovery for property damages. Allowing your coverage to lapse means giving up. If you obtain a loan to buy a car, you must have insurance to cover the car. If you fail to obtain insurance or let your insurance lapse, the lender likely. if you have security devices;; a picture of your home;; the coverages and limits you want. any prior property or liability losses. Homeowners insurance is. How can a lapsed policy hurt homeowners? A lapsed policy leaves you without coverage, and that could be devastating if you experience damage before you get. If your house is paid off (as in no mortgage or liens against it), and you discontinue the homeowners insurance, there will be no penalties. You. if you have security devices;; a picture of your home;; the coverages and limits you want. any prior property or liability losses. Homeowners insurance is. After your homeowners insurance is cancelled or nonrenewed, you can shop around and try to get a policy with a different insurer. As there is a “risk” mark next to your name, your premiums may still be slightly higher than they were before your policy lapsed. To get a fair deal, make sure. If your policy has lapsed, you will be responsible for paying for your vehicle's repairs and your medical visits directly and will not have an active policy to. It's the type of policy your mortgage lender will buy for you if you let your homeowners policy lapse. It's also used for vacation homes and when you can't find. After a car insurance lapse, you may find it harder to get insurance at an affordable rate. You may even have to resort to a company that specializes in risky. to list them as the mortgagee on the policy. If you let your insurance lapse, your mortgage lender will likely obtain its own insurance. You may be required to. “However, during the lapse in coverage, any claims filed wouldn't be paid, and when there are too many lapses, even though you eventually pay, that can be.

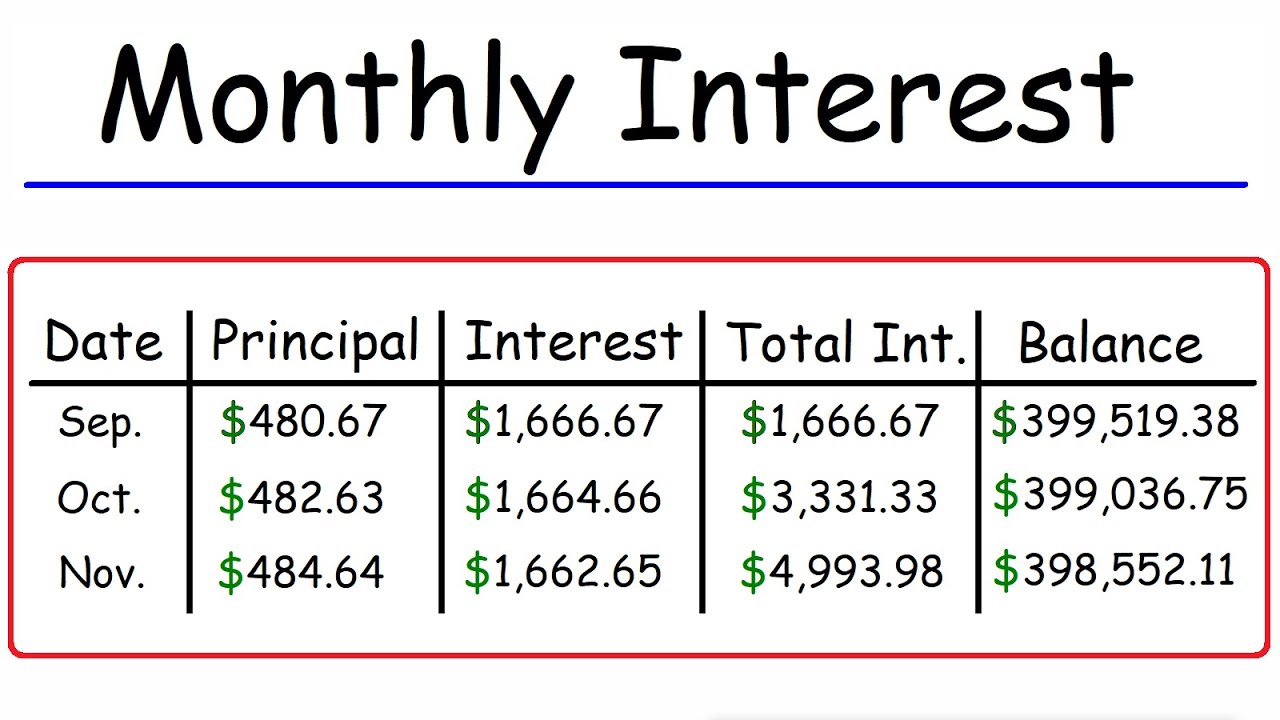

Best Interest Rate For 100 000 Dollars

It will take 9 years for the $1, to become $2, at 8% interest. This formula works best for interest rates between 6 and 10%, but it should also work. At a % fixed interest rate, a year $, mortgage may cost you around $ per month, while a year mortgage has a monthly payment of around $ Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. Calculated values assume that principal and interest remain on deposit and are rounded to the nearest dollar. All APYS are subject to change. Rates of the. Checking · Associated Choice Checking, $ · % · % ; Money Market · Associated Select Money Mkt, $1, · % · % ; Savings · Associated Zero Interest Sav. APRs listed are our best rates. Your 5/5 Adjustable-Rate Mortgage (ARM): Variable rate loan, interest and payments may increase after consummation. dollars to score the highest rate. What is a good rate for a money market account? Money market accounts have variable interest rates, which means they can. best suit your financial needs. How much would you like to borrow? $. Payment FrequencyMonthly. Weekly; Biweekly; Semi-Monthly; Monthly. Interest Rate. 0; Best high interest saving account for $, cash deposit? · simplii financial- % for 5 months for opening a saving account and earn $ It will take 9 years for the $1, to become $2, at 8% interest. This formula works best for interest rates between 6 and 10%, but it should also work. At a % fixed interest rate, a year $, mortgage may cost you around $ per month, while a year mortgage has a monthly payment of around $ Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. Calculated values assume that principal and interest remain on deposit and are rounded to the nearest dollar. All APYS are subject to change. Rates of the. Checking · Associated Choice Checking, $ · % · % ; Money Market · Associated Select Money Mkt, $1, · % · % ; Savings · Associated Zero Interest Sav. APRs listed are our best rates. Your 5/5 Adjustable-Rate Mortgage (ARM): Variable rate loan, interest and payments may increase after consummation. dollars to score the highest rate. What is a good rate for a money market account? Money market accounts have variable interest rates, which means they can. best suit your financial needs. How much would you like to borrow? $. Payment FrequencyMonthly. Weekly; Biweekly; Semi-Monthly; Monthly. Interest Rate. 0; Best high interest saving account for $, cash deposit? · simplii financial- % for 5 months for opening a saving account and earn $

Granted, you won't be earning hundreds of dollars in interest Help your money grow by finding the savings account that offers the best rates and features for. If you take a $, personal loan with a 12 year term and a % interest rate your monthly payment should be around $ If you take the full 12 years to. Step 3: Interest Rate. Estimated Interest Rate. Your estimated annual interest It's a great first step toward protecting your money and it only takes a few. Financial Partners Credit Union offers % APY for 8 months. What is the best CD rate for $,? Inova Bank offers one of the best CD interest rates today. Money Market Savings account. Bank of America Interest Checking®†. Rate %, APY %†. Less than $50,, , $50, - $99,, , $, and. best rate available. How much money do you need? $1, Minimum and $, Maximum. Amount must be between $1, and $, What loan term do you want. TD Signature Savings. Rates up to % APY* with minimum balance of $,†. Get a relationship rate when you link to an eligible TD Bank account1. Monthly. Use this calculator to estimate the value of the investments in your TFSA when you're ready to withdraw them and compare this amount to the value of your. This can help you determine the best plan for making actual payments. Our team will work with you to secure a land loan with a competitive interest rate and. Want to find your interest rate? Credible lets you compare rates from multiple lenders to find your best prequalified rate. Jump to Calculator. Calculating. Louis, gave us a nuanced view of the situation: “One of the primary considerations is the interest rate on the debt you're holding. One of the best options is. interest rates than those with fair or poor credit. Often, borrowers Best Low-Interest Personal Loans. Hill adds that options like a home equity. Enter a dollar value of an investment at the outset. Input a starting year and an end year. Enter an annual interest rate and an annual rate of inflation. interest rates than those with fair or poor credit. Often, borrowers Best Low-Interest Personal Loans. Hill adds that options like a home equity. Online Financial Websites: Visit websites like Bankrate, NerdWallet, or Forbes to find updated lists of banks with the best interest rates. Bank Websites: Check. How to invest $K: Five best ways. Here are some of the best ways to dollar that is no longer earning compound interest. The most obvious way to. Personal loan interest rates as low as % APRFootnote 1,Footnote 2 The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with. Fees may reduce earnings. 2. In order to qualify for a Relationship Rate on Standard Savings, you must have a linked Standard Checking, Performance Checking. rate, this rate increases the closer your NAV is to USD , Interest We will publish the current rates on a best-efforts basis. Interest rates. You expect the best; we deliver it. Savings · Mortgages · Insights · Digital Interest rates may change as often as daily without prior notice. Fees may.

Withdraw From Roth 401 K

Distribution rules. While Roth IRA assets can generally be withdrawn at any time, you can only withdraw funds from your Roth (k) when permitted by the plan. Can I withdraw money from my IRA early without penalty? If you are at least age 59½, a penalty would not apply. Before 59½, an additional 10% federal tax on. With a Roth (k), your non-qualified withdrawals are a pro-rata amount of your contributions and earnings, and you may potentially be subject to the 10% early. You can also withdraw Roth funds tax-free if you become disabled. If you Resources. (k) Option – Roth Post-Tax Contributions. Read this newsletter. You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. However, a. (k) withdrawals- If your employer's (k) plan allows for withdrawals for education expenses, you can withdraw from your (k) and avoid the IRS' 10% early. Yes, a distribution from a designated Roth account must be reported on Form –R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. Distribution rules. While Roth IRA assets can generally be withdrawn at any time, you can only withdraw funds from your Roth (k) when permitted by the plan. Can I withdraw money from my IRA early without penalty? If you are at least age 59½, a penalty would not apply. Before 59½, an additional 10% federal tax on. With a Roth (k), your non-qualified withdrawals are a pro-rata amount of your contributions and earnings, and you may potentially be subject to the 10% early. You can also withdraw Roth funds tax-free if you become disabled. If you Resources. (k) Option – Roth Post-Tax Contributions. Read this newsletter. You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. However, a. (k) withdrawals- If your employer's (k) plan allows for withdrawals for education expenses, you can withdraw from your (k) and avoid the IRS' 10% early. Yes, a distribution from a designated Roth account must be reported on Form –R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates.

Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income. That said, you'll report the taxable. Contributions grow tax-free, like a traditional (k), but withdrawals from Roth (k)s are tax-free if you've had the account for five years and are at least. Withdrawals are taxed as ordinary income. If withdrawn before age 59½, distribution is subject to ordinary income tax and a 10% early withdrawal penalty may. A Roth (k) deferral is an after-tax contribution, which means you must pay current income tax on the deferral. Since you have already paid tax on the. Roth IRA contributions can be withdrawn penalty-free at any time. Roth k does not have a mechanism for withdrawing contributions. If you take. With a traditional (k), you defer paying taxes until you withdraw the money upon retirement, or in a permissible distribution event. you can withdraw the amount of your own contributions at any time without tax or penalty (unless there is some penalty imposed by an investment. Withdrawals of your traditional IRA contributions before age 59½ will result in regular income tax on the taxable amount of your withdrawal plus a 10% federal. However, unlike the Roth IRA, contributions can't be withdrawn from a Roth (k) without penalty until five years after the plan starts, while a Roth IRA's. A Roth (k) is an employer-sponsored retirement savings account that is funded with after-tax money. As long as certain conditions are met, withdrawals in. In order for a distribution of Roth assets to be qualified, you cannot withdraw earnings until it's been at least 5 years since you first contributed to a Roth. Although you generally have up to five years to repay loans from your (k) plan account, leaving your job (or losing it) before the loans are repaid may mean. Can I withdraw money from my IRA early without penalty? If you are at least age 59½, a penalty would not apply. Before 59½, an additional 10% federal tax on. You pay the taxes on contributions and earnings when the savings are withdrawn. As a benefit to employees, some employers will match a portion of an employee's. Early withdrawals of a traditional (k) will usually incur a 10% penalty and income tax on the full withdrawal, regardless of how much you have contributed. Contributions grow tax-free, like a traditional (k), but withdrawals from Roth (k)s are tax-free if you've had the account for five years and are at least. Any earnings on your investment will be tax deferred, and withdrawals from your Roth account are generally free from income taxes. To avoid paying taxes on your. Typically, with (k) plans, (b) plans, and individual retirement accounts (IRAs), you can start to make penalty-free withdrawals when you turn 59 ½. If you. Later, you pay taxes on your contributions and any investment earnings when you withdraw from your account. Roth After-Tax (k). Your contributions are taxed.

How To Program For Dummies

A popular choice is "Coding for Dummies" by Nikhil Abraham, so feel free to check it out. Nevertheless, the classic approach of buying a textbook can contribute. Let there be code! Beginning Programming All-in-One For Dummies offers one guide packed with 7 books to teach you programming across multiple languages.. Beginning programming for dummies book. I am looking to learn the basic concepts of programming instead of learning a specific programming. To help you get to where you want to go with C, this 2nd edition of C Programming For Dummies covers everything you need to begin writing programs, guiding you. Beginning Programming All-in-One For Dummies offers one guide packed with 7 books to teach you programming across multiple languages. Adding some coding know-how to your skills can help launch a new career or bolster an old one. Coding All-in-One For Dummies offers an ideal starting place for. Beginning Programming All-In-One For Dummies Cheat Sheet. By: Wallace Wang and. Updated: From The Book: Beginning Programming All-in-One For. Dummies helps everyone be more knowledgeable and confident in applying what they know. Whether it's to pass that big test, qualify for that big promotion or. Additionally, Beginning Programming All-In-One Desk Reference For Dummies shows you how to decide what you want your program to do, turn your instructions into. A popular choice is "Coding for Dummies" by Nikhil Abraham, so feel free to check it out. Nevertheless, the classic approach of buying a textbook can contribute. Let there be code! Beginning Programming All-in-One For Dummies offers one guide packed with 7 books to teach you programming across multiple languages.. Beginning programming for dummies book. I am looking to learn the basic concepts of programming instead of learning a specific programming. To help you get to where you want to go with C, this 2nd edition of C Programming For Dummies covers everything you need to begin writing programs, guiding you. Beginning Programming All-in-One For Dummies offers one guide packed with 7 books to teach you programming across multiple languages. Adding some coding know-how to your skills can help launch a new career or bolster an old one. Coding All-in-One For Dummies offers an ideal starting place for. Beginning Programming All-In-One For Dummies Cheat Sheet. By: Wallace Wang and. Updated: From The Book: Beginning Programming All-in-One For. Dummies helps everyone be more knowledgeable and confident in applying what they know. Whether it's to pass that big test, qualify for that big promotion or. Additionally, Beginning Programming All-In-One Desk Reference For Dummies shows you how to decide what you want your program to do, turn your instructions into.

Read Beginning Programming For Dummies by Wallace Wang with a free trial. Read millions of eBooks and audiobooks on the web, iPad, iPhone and Android. Beginning Programming ALL-IN-ONE DESK REFERENCE FOR DUMMIES® Read it now on the O'Reilly learning platform with a day free trial. O'Reilly members get. Coding for Dummies (or really smart people who just don't get it) I always knew I had good ideas. I thought I could meet the right person who. Beginning Programming for Dummies shows you how computer programming works without all the technical details or hard programming language. I highly recommend Wallace Wang's Beginning Programming for Dummies to anyone looking to learn programming for the first time. I'm a technical writer who is. Beginning Programming for Dummies shows you how computer programming works without all the technical details or hard programming language. Coding All-in-One For Dummies [1 ed.] , , , Polish up your coding skills! The demand for people with coding. Coding for Dummies is an incredible book that can teach coding basics and help you get started. It is suitable for years old because of its simplicity. The Unofficial C For Dummies Website. This page supports the C programming books written by Dan Gookin, as well as the C language training courses offered. Let there be code! Beginning Programming All-in-One For Dummies offers one guide packed with 7 books to teach you programming across multiple languages. Coding. code is and what it can do Touring your first program using code Understanding programming languages used to write code - Selection from Coding For Dummies [. Coding All-in-One For Dummies offers an ideal starting place for learning the languages that make technology go. This edition gets you started with a helpful. Buy a cheap copy of Beginning Programming For Dummies book by Wallace Wang. Do you think the programmers who work at your office are magical wizards who. For my earlier title, Beginning C Programming For Dummies, click here. From the Book. Answers to Exercises · Source Code Listings · Errata. Supplemental. The C Programming For Dummies Approach To create a program in the Code::Blocks IDE, you must build the project. This single step does several. Programming. FOR. DUMmIES‰. 4TH EDITION. Page 2. Page 3. Wallace Wang. Beginning. Programming. FOR. DUMmIES‰. 4TH EDITION. Page 4. Beginning Programming For. C Programming For Dummies Cheat Sheet. By: Dan Gookin and. Updated: From The Book: C Programming For Dummies. Programming with Python®. Page 4. Page 5. Beginning. Programming with Python® by John Paul Mueller. Page 6. Beginning Programming with Python® For Dummies®. Coding For Kids For Dummies · Overview · About The Author · Have This Book? · Articles From The Book · Related Books. Coding All-In-One for Dummies is a comprehensive guide that covers various programming languages and tools. It's perfect for beginners looking to learn coding.

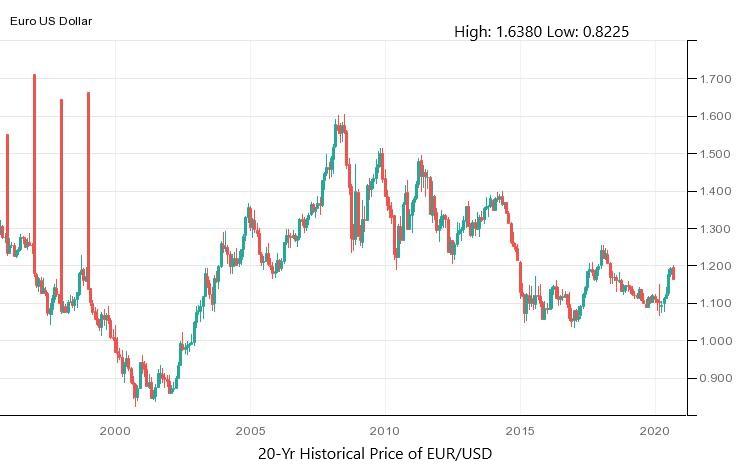

Eurusd Fx Rate

EUR/USD is the FX ticker for the exchange rate between the US dollar and the euro. It tells traders how many US dollars are needed to buy a single euro. The exchange rate for Euro to US dollars is currently today, reflecting a % change since yesterday. Over the past week, the value of Euro has. Find the latest EUR/USD (EURUSD=X) stock quote, history, news and other vital information to help you with your stock trading and investing. View the latest EUR to USD exchange rate, news, historical charts, analyst ratings and financial information from WSJ. Exchange Rate Euro to US Dollar Converter. EUR = USD. Aug EUR/USD%; USD/JPY+%; GBP/USD%; USD/CHF+%; USD/CAD+. The chart below shows the Euro to Dollar exchange rate during the past ten years, spanning from until You will notice that the FX rate has ranged. Euro/US Dollar FX Spot Rate · Price (USD) · Today's Change / % · 1 Year change+% · 52 week range - EURUSD=X - EUR/USD ; Aug 26, , , , , ; Aug 23, , , , , Get the latest 1 Euro to US Dollar rate for FREE with the original Universal Currency Converter. Set rate alerts for to and learn more about Euros and US. EUR/USD is the FX ticker for the exchange rate between the US dollar and the euro. It tells traders how many US dollars are needed to buy a single euro. The exchange rate for Euro to US dollars is currently today, reflecting a % change since yesterday. Over the past week, the value of Euro has. Find the latest EUR/USD (EURUSD=X) stock quote, history, news and other vital information to help you with your stock trading and investing. View the latest EUR to USD exchange rate, news, historical charts, analyst ratings and financial information from WSJ. Exchange Rate Euro to US Dollar Converter. EUR = USD. Aug EUR/USD%; USD/JPY+%; GBP/USD%; USD/CHF+%; USD/CAD+. The chart below shows the Euro to Dollar exchange rate during the past ten years, spanning from until You will notice that the FX rate has ranged. Euro/US Dollar FX Spot Rate · Price (USD) · Today's Change / % · 1 Year change+% · 52 week range - EURUSD=X - EUR/USD ; Aug 26, , , , , ; Aug 23, , , , , Get the latest 1 Euro to US Dollar rate for FREE with the original Universal Currency Converter. Set rate alerts for to and learn more about Euros and US.

Find the current Euro US Dollar rate and access to our EUR USD converter, charts, historical data, news, and more Exchange Rates Table · US Dollar Index. View the latest EUR to USD exchange rate, news, historical charts, analyst ratings and financial information from WSJ. Find the latest currency exchange rate, historical data and news for (EURUSD) at baton-rouge-tree-services.site Get EUR/USD (EUR=:Exchange) real-time stock quotes, news, price and Rate Mortgages · Affording a Mortgage. SELECT. All Insurance · Best Life Insurance. ECB euro reference exchange rate. 29 August EUR 1 = USD (%). Change from 29 August to 29 August Min (3 October ). Check live exchange rates for 1 EUR to USD with our EUR to USD chart. Exchange euros to US dollars at a great exchange rate with OFX. EUR to USD trend EUR/USD. Live EUR/USD Exchange Rate Data, Calculator, Chart, Statistics, Volumes and History ; Today's High: ; Today's Low: ; Previous day's Close: Get the latest Euro to United States Dollar (EUR / USD) real-time quote, historical performance, charts, and other financial information to help you make. EUR/USD exchange rate. Charts, forecast poll, current trading positions and technical analysis. Keep informed on EUR/USD updates. EURUSD Euro US DollarCurrency Exchange Rate Live Price Chart ; EURAUD, , , % ; EURNZD, , , %. The Euro US Dollar Exchange Rate - EUR/USD is expected to trade at by the end of this quarter, according to Trading Economics global macro models and. EUR to USD | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Euro. FXStreet. EUR/USD slides below on soft German inflation, US Dollar's recovery. 4 hours ago ; DailyFX. EUR/USD, GBP/USD, and Gold – Latest Sentiment. Euro Dollar Exchange Rate (EUR USD) - Historical Chart ; , , , , The EUR/USD (or Euro Dollar) currency pair belongs to the group of 'Majors', a way to mention the most important pairs in the world. This group also includes. ECB euro reference exchange rate ; Min (3 October ). ; Max (26 August ). ; Average. CME listed FX futures offer more precise risk management of EUR/USD FX Swap Rate Monitor · FX Options Vol Converter · FX Quarterly Roll Analyzer. EUR/USD FX rate, up until Aug 27, The euro-to-dollar exchange rate fluctuated significantly in , reaching its lowest recorded value since during. EUR/USD Forward Rates ; One Week, , ; Two Week, , ; Three Week, , ; One Month, , The euro foreign exchange reference rates (also known as the ECB reference rates) are published by the ECB at around CET. Reference rates for all the.

Free Money From Games

Bubble Cash is the top classic bubble shooter game for your iPhone and iPad, giving you an exciting and rewarding experience. Get Items, earn from mobile games, and track your progress everywhere! Like all the best things in life, Buff is free. The only thing you share with us. Get paid for testing apps, games & surveys. Earn up to $ per offer Want to earn free cash within minutes? Here's how. Start earning now. See our. Results · Viva Vegas Slots Free Slots & Casino Games - Play Free Classic Las Vegas Slot Machines Online · Real money casino games · Bingo Win Cash - Lucky Bingo. Duelit lets you win money while playing games. Challenge your friends or participate in tournaments and win. Best Of Big Cash Games · 8 ball pool cricket bulb smash · soccer fruit chop car race · egg toss fantasy cricket · baseket ball · nh holdem point rummy callbreak. Earn cash money rewards by trying free games, apps, & watching short videos! Invite friends to the Mode Earn app and earn gift cards, money, and cash! Swagbucks: Offers various ways to earn, including playing games. Mistplay: Rewards users for playing mobile games. HQ Trivia: A live trivia game. Test your skills, there's lots of ways to win - absolutely FREE.. We have instant, daily and monthly giveaways, where sweepstakes winners can take home tens. Bubble Cash is the top classic bubble shooter game for your iPhone and iPad, giving you an exciting and rewarding experience. Get Items, earn from mobile games, and track your progress everywhere! Like all the best things in life, Buff is free. The only thing you share with us. Get paid for testing apps, games & surveys. Earn up to $ per offer Want to earn free cash within minutes? Here's how. Start earning now. See our. Results · Viva Vegas Slots Free Slots & Casino Games - Play Free Classic Las Vegas Slot Machines Online · Real money casino games · Bingo Win Cash - Lucky Bingo. Duelit lets you win money while playing games. Challenge your friends or participate in tournaments and win. Best Of Big Cash Games · 8 ball pool cricket bulb smash · soccer fruit chop car race · egg toss fantasy cricket · baseket ball · nh holdem point rummy callbreak. Earn cash money rewards by trying free games, apps, & watching short videos! Invite friends to the Mode Earn app and earn gift cards, money, and cash! Swagbucks: Offers various ways to earn, including playing games. Mistplay: Rewards users for playing mobile games. HQ Trivia: A live trivia game. Test your skills, there's lots of ways to win - absolutely FREE.. We have instant, daily and monthly giveaways, where sweepstakes winners can take home tens.

Solitaire Cube is a card game app that allows you to test your card skills and win real money. The game is available for free on iOS and Android and is perfect. Participate in our free tournaments and stand a chance to win real cash prizes. Game Champions hosts regular Sweepstakes contests, giving you the thrill of. At Solitaire Cash, we believe in providing the best gaming experience to our users. This is why we offer a reward system, where you can earn real money by. What's baton-rouge-tree-services.site All About? baton-rouge-tree-services.site is the ultimate GPT (Get Paid To) site that turns your gaming passion into real cash. You get to. Some of the best money-making games include Blackout Bingo, Dominoes Gold, Solitaire Cubes, Pool Payday, and Spades Cash. The #1 loyalty program for mobile gamers. Discover games you'll love, and earn free gift cards for playing. Download Mistplay today! Most Played Games · Cyber Soldier · Tetris cube · Propeller Airplane · Pirates Slay · Tomb Runner · Ninja Action · Red And Green · Rotate Puzzle Cats And Dogs. This article explores the top 10 free games that not only provide immense entertainment but also offer the opportunity to earn real money instantly. We have collected 11 popular money games for you to play on Little Games. They include new and top money games such as Money Clicker, Gold Miner Classic, Bob. Get paid to play games and earn cash rewards. Play games for real money and start earning Plus, earning money while playing games gives your free time a. Lucktastic: Lucktastic is a mobile app that offers free scratch card games where users can win cash prizes and gift cards. Players can earn. Coin Saver Challenge. Coin Saver Challenge Game. Coin Saver Challenge is a coin identification game for kids. Choose to play on easy, medium. It operates similarly to Swagbucks with the option to play games and earn money. Complete an 'offer' to earn coins. These coins can then be cashed out in. Earn cash, gift cards and prizes on InboxDollars when you play games online free. · You love playing online games. Make a few dollars at it. · Sign up for. Best Of Big Cash Games · 8 ball pool cricket bulb smash · soccer fruit chop car race · egg toss fantasy cricket · baseket ball · nh holdem point rummy callbreak. EazeGames is a reliable and enjoyable platform for anyone looking for ways to make money from home. With a range of games and the ability to make money quickly. Our free educational games motivate kids to hone and develop this skill by combining instructional tools with competitive fun. Real Money Earning Games on MPL · What are money-earning games? · How do I earn money in these games on MPL? · Are all money-earning games free to play? · Can I. InboxDollars is a free app that offers a variety of ways to make money fast including surveys that pay between $ and $5, earning cash back for playing games. Earn cash, gift cards and prizes on InboxDollars when you play games online free. · You love playing online games. Make a few dollars at it. · Sign up for.

Ten Year Mortgage

Higher interest rates on shorter-term bonds matter because mortgages are generally held for fewer than 10 years. Prepayment risk is higher than in recent. ARM interest rates and payments are subject to increase after the initial fixed-rate period (5 years for a 5y/6m ARM, 7 years for a 7y/6m ARM and 10 years for a. A year mortgage is a home loan that lets you repay your lender over just 10 years. It could be a good option for you if you're looking to refinance. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Chart: Prime Rate versus the rate on a Year Fixed-Rate Mortgage versus the rate on a Year Fixed-Rate Mortgage versus the Yield on the Year US. Track 10 Year US Treasury Bond (10 Year Treasuries) Yields Today's Mortgage Rates | Mortgage Calculators · 8/29/ 30 Yr. Fixed Rate. %. +%. Today's mortgage rate for a year fixed-rate mortgage for purchase or refinance, conforming to $1,,**, is % (% APR). "If a homeowner is 13 years into an existing year mortgage at % and refinances to a new year mortgage at a % rate, the monthly payment climbs only. With a year fixed-rate mortgage, you'll pay off the loan in 10 years with the same interest rate throughout the term. Additional refinance resources. How. Higher interest rates on shorter-term bonds matter because mortgages are generally held for fewer than 10 years. Prepayment risk is higher than in recent. ARM interest rates and payments are subject to increase after the initial fixed-rate period (5 years for a 5y/6m ARM, 7 years for a 7y/6m ARM and 10 years for a. A year mortgage is a home loan that lets you repay your lender over just 10 years. It could be a good option for you if you're looking to refinance. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Chart: Prime Rate versus the rate on a Year Fixed-Rate Mortgage versus the rate on a Year Fixed-Rate Mortgage versus the Yield on the Year US. Track 10 Year US Treasury Bond (10 Year Treasuries) Yields Today's Mortgage Rates | Mortgage Calculators · 8/29/ 30 Yr. Fixed Rate. %. +%. Today's mortgage rate for a year fixed-rate mortgage for purchase or refinance, conforming to $1,,**, is % (% APR). "If a homeowner is 13 years into an existing year mortgage at % and refinances to a new year mortgage at a % rate, the monthly payment climbs only. With a year fixed-rate mortgage, you'll pay off the loan in 10 years with the same interest rate throughout the term. Additional refinance resources. How.

Fixed-rate mortgages are the most common kind of home loan, and these track the year Treasury yield. While a fixed mortgage rate isn't the same as the The following table shows current year mortgage refinance rates available in Mountain View. You can use the menus to select other loan durations, alter the. Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Rates, terms, and fees as of 8/30/ AM Eastern Daylight Time and. Fixed year mortgage rates in the United States averaged percent in the week ending August 23 of This page provides the latest reported value. To qualify for a year mortgage, you'll need to prove you can afford the payments. For a conventional mortgage, you'll also need at least a 3% down payment, 2. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Get your current 10 year fixed rate mortgage offers at loanDepot, a direct lender offering low fixed rate mortgage loans. Our 10 yr fixed rates might be a. Average year mortgage rates tend to be between 3% and 4%, but they vary. Here are some of the best year mortgage rates and providers to help you decide. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. With a fixed rate mortgage loan from PNC Bank, you will have consistent payments for the life of your home loan. Compare year fixed rates from multiple lenders to find the best year mortgage rate. Since mortgages are typically held for fewer than 10 years, they have a shorter duration than year Treasuries. Since early , and for the first time since. Refinancing to a year term can save you many thousands of dollars compared to a longer term loan. In exchange, you must commit a lot of money every month to. While the year loan is more popular, the year builds equity exceptionally quickly & charges a lower rate of interest which saves even more money. The. Compare the Best 10 Year Fixed Rate Mortgages from the UK's top providers. Updated to reflect the latest rates, begin your comparison today. A year mortgage is the shortest fixed-rate loan available for a home purchase. As with longer-term mortgage loans, the monthly payment remains the same. The main reason to fix a mortgage is to lock in today's interest rate for a set period, such as for two, five, 10 years or longer. Once you're locked in, it. 10/6 ARM loans—loans whose interest rates will now readjust twice a year (the “6” refers to six-month increments) over the remaining life of the loan. What's a 10 year fixed mortgage rate? A year fixed-rate mortgage will keep you locked in to the same interest rate on your mortgage for a decade. year. Obtaining a year mortgage is beneficial for people who can afford high monthly payments. It's also a great option if you want to refinance to a shorter term.